European Commission Adjusts Eurozone Growth Forecasts Amid Global Economic Challenges

Projected growth for the eurozone in 2025 is now 0.9%, reduced from 1.3%, influenced by US tariffs and other geopolitical tensions.

Brussels – The European Commission has revised its economic growth forecasts for the eurozone, primarily due to rising global uncertainties stemming from US tariffs, the ongoing conflict between Russia and Ukraine, and geopolitical tensions in the Middle East.

In its Spring Economic Forecasts, the Commission now anticipates an expansion in the eurozone of 0.9 percent for 2025 and 1.4 percent for 2026, a downward adjustment from the previous estimates of 1.3 percent for 2025 and 1.6 percent for 2026.

Moreover, the gross domestic product (GDP) growth projections for the European Union have also been altered, with the new forecasts indicating a rise of 1.1 percent in 2025 instead of the previously estimated 1.5 percent, and a slight reduction for 2026 from 1.8 percent to 1.5 percent.

This translates to a reduction of 0.4 percentage points for 2025 and 0.3 percentage points for 2026.

The potential imposition of tariffs by the administration of former US President Donald Trump has prompted notable concern among EU officials.

The European Commission's forecasts are predicated on the assumption that these tariffs will be enacted, particularly the proposed 10 percent levy on goods imported from the EU into the United States.

In a statement accompanying the revised forecasts, the Commission indicated that the substantial downward revision of the growth outlook is largely attributed to a deteriorating global trade environment and heightened uncertainty in trade policy, which could result in decreased export levels and subsequent negative repercussions for the eurozone economies.

The global economic landscape also contributes to this outlook, with growth outside the EU projected at 3.2 percent for both 2025 and 2026, a decrease from the 3.6 percent anticipated in the fall of 2024. This downward adjustment correlates with a dimmed outlook for major economies, particularly the United States and China.

Analysts have noted a sharper decline in global trade, which is expected to further impact the eurozone's performance.

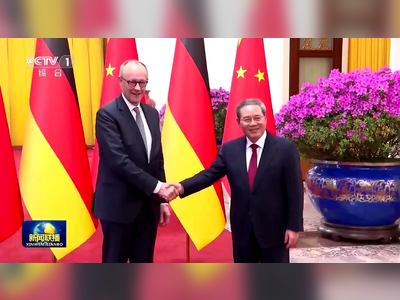

The economic situation in Germany, the largest economy in Europe, remains particularly concerning, as it is predicted to stagnate in 2025 with growth at 0 percent following a slight recession of -0.2 percent at the end of 2024. While the European Commission anticipates that most EU member states will return to growth by 2025, countries such as Austria are expected to face contractions, with forecasts showing a decline of -0.3 percent.

In terms of defense spending, the European Commission acknowledges that increased government expenditures in this area have become a priority, yet it notes that many member states have not provided sufficiently detailed spending plans to be factored into the economic framework.

Calls to suspend the internal stability pact to accommodate defense financing have been made, but clarity on the financial impacts remains unattainable at this juncture.

Despite the prevailing uncertainties, inflationary trends present a comparatively positive aspect of the economic landscape.

The inflation rate in the eurozone is projected to stabilize at 2.4 percent by the end of the current year, with expectations of a decline to 2.1 percent in 2025 and further down to 1.8 percent in 2026, partially credited to the appreciation of the euro and decreases in energy costs.

In its Spring Economic Forecasts, the Commission now anticipates an expansion in the eurozone of 0.9 percent for 2025 and 1.4 percent for 2026, a downward adjustment from the previous estimates of 1.3 percent for 2025 and 1.6 percent for 2026.

Moreover, the gross domestic product (GDP) growth projections for the European Union have also been altered, with the new forecasts indicating a rise of 1.1 percent in 2025 instead of the previously estimated 1.5 percent, and a slight reduction for 2026 from 1.8 percent to 1.5 percent.

This translates to a reduction of 0.4 percentage points for 2025 and 0.3 percentage points for 2026.

The potential imposition of tariffs by the administration of former US President Donald Trump has prompted notable concern among EU officials.

The European Commission's forecasts are predicated on the assumption that these tariffs will be enacted, particularly the proposed 10 percent levy on goods imported from the EU into the United States.

In a statement accompanying the revised forecasts, the Commission indicated that the substantial downward revision of the growth outlook is largely attributed to a deteriorating global trade environment and heightened uncertainty in trade policy, which could result in decreased export levels and subsequent negative repercussions for the eurozone economies.

The global economic landscape also contributes to this outlook, with growth outside the EU projected at 3.2 percent for both 2025 and 2026, a decrease from the 3.6 percent anticipated in the fall of 2024. This downward adjustment correlates with a dimmed outlook for major economies, particularly the United States and China.

Analysts have noted a sharper decline in global trade, which is expected to further impact the eurozone's performance.

The economic situation in Germany, the largest economy in Europe, remains particularly concerning, as it is predicted to stagnate in 2025 with growth at 0 percent following a slight recession of -0.2 percent at the end of 2024. While the European Commission anticipates that most EU member states will return to growth by 2025, countries such as Austria are expected to face contractions, with forecasts showing a decline of -0.3 percent.

In terms of defense spending, the European Commission acknowledges that increased government expenditures in this area have become a priority, yet it notes that many member states have not provided sufficiently detailed spending plans to be factored into the economic framework.

Calls to suspend the internal stability pact to accommodate defense financing have been made, but clarity on the financial impacts remains unattainable at this juncture.

Despite the prevailing uncertainties, inflationary trends present a comparatively positive aspect of the economic landscape.

The inflation rate in the eurozone is projected to stabilize at 2.4 percent by the end of the current year, with expectations of a decline to 2.1 percent in 2025 and further down to 1.8 percent in 2026, partially credited to the appreciation of the euro and decreases in energy costs.

AI Disclaimer: An advanced artificial intelligence (AI) system generated the content of this page on its own. This innovative technology conducts extensive research from a variety of reliable sources, performs rigorous fact-checking and verification, cleans up and balances biased or manipulated content, and presents a minimal factual summary that is just enough yet essential for you to function as an informed and educated citizen. Please keep in mind, however, that this system is an evolving technology, and as a result, the article may contain accidental inaccuracies or errors. We urge you to help us improve our site by reporting any inaccuracies you find using the "Contact Us" link at the bottom of this page. Your helpful feedback helps us improve our system and deliver more precise content. When you find an article of interest here, please look for the full and extensive coverage of this topic in traditional news sources, as they are written by professional journalists that we try to support, not replace. We appreciate your understanding and assistance.