Euro Area Bank Interest Rates Decrease in December 2024

Key indicators show a decline in borrowing and deposit rates for both corporations and households across the euro area.

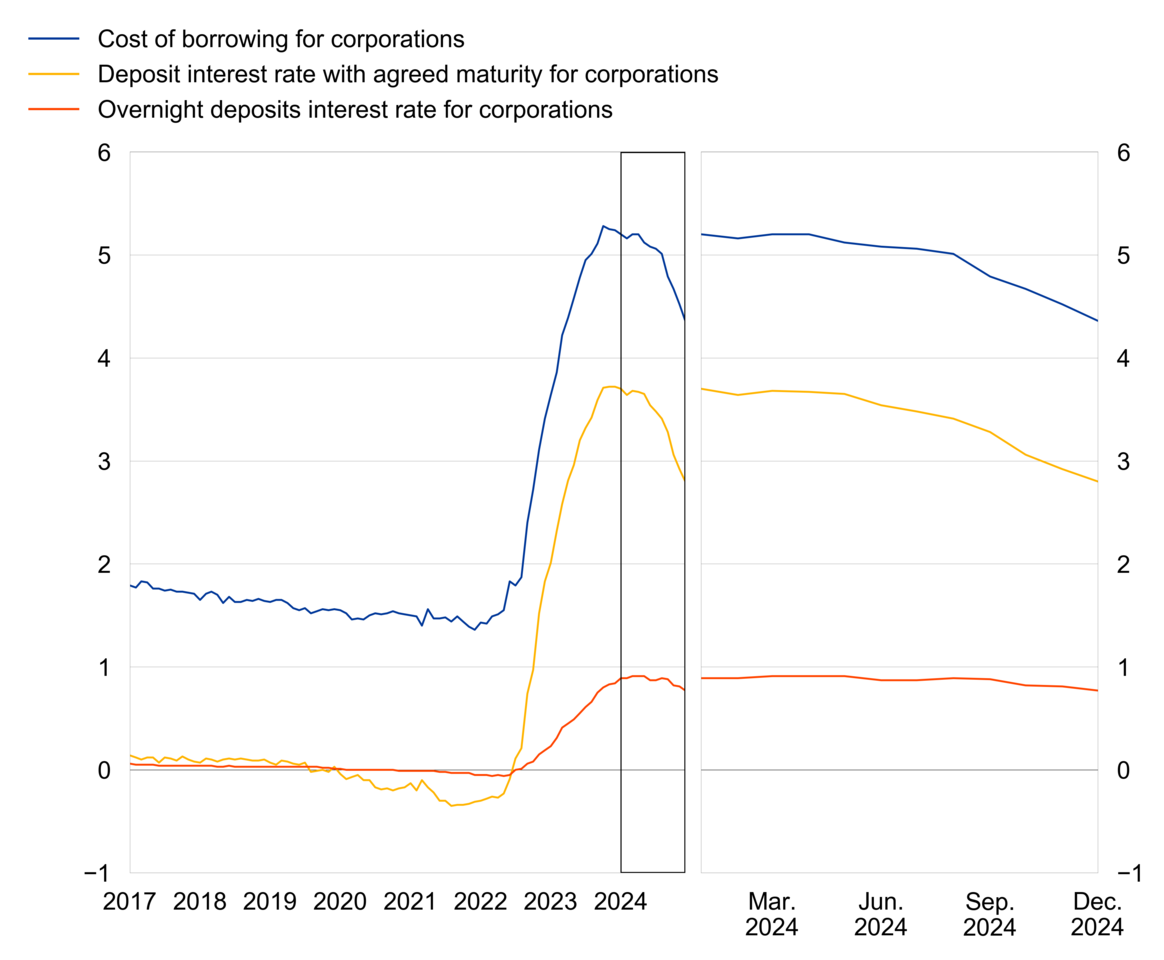

On 4 February 2025, the European Central Bank (ECB) released data indicating a decrease in bank interest rates for both corporations and households in the euro area for December 2024. The composite cost-of-borrowing indicator for new loans to corporations fell by 16 basis points to 4.36%, while the indicator for new loans to households for house purchases decreased by 8 basis points to 3.39%.

For corporations, the interest rate on new loans exceeding €1 million with a floating rate and an initial fixation period of up to three months decreased by 11 basis points to 4.31%.

The rate for new loans of the same amount, with an initial fixation period of over three months and up to one year, fell by 14 basis points to 4.06%.

Additionally, the interest rate on new loans over €1 million with an initial rate fixation period of more than ten years decreased by 6 basis points to 3.42%.

A notable reduction was also seen in loans of up to €250,000, where the average rate charged for floating rate loans with an initial fixation period of up to three months fell by 17 basis points to 4.63%.

In terms of deposits from corporations, the interest rate on deposits with an agreed maturity of up to one year decreased by 13 basis points to 2.80%, and overnight deposits saw a decline of 4 basis points to 0.77%.

The interest rate for new loans to sole proprietors and unincorporated partnerships with a floating rate and an initial fixation period of up to one year experienced a larger decrease of 29 basis points, settling at 4.63%.

For households, the composite cost-of-borrowing indicator for loans aimed at house purchases also saw a decline.

The interest rate on loans with a floating rate and an initial fixation period of up to one year decreased by 12 basis points to 4.15%.

Rates on housing loans with initial fixation periods over one and up to five years fell by 5 basis points to 3.57%, while loans with fixation periods over five up to ten years decreased by 7 basis points to 3.36%.

Further, the rate on loans with an initial fixation period exceeding ten years fell by 7 basis points to 3.09%.

Loans to households for consumption saw a significant drop of 22 basis points, reaching 7.36%.

Regarding deposits from households, the interest rate on deposits with an agreed maturity of up to one year decreased by 16 basis points to 2.45%.

Rates on deposits redeemable at three months' notice remained unchanged at 1.74%, and overnight deposits from households stayed constant at 0.35%.

These interest rate changes reflect ongoing adjustments in the financial landscape of the euro area and come amid broader economic considerations.

The data is part of a comprehensive set of bank interest rate statistics maintained by the ECB, which can be visualized for individual euro area countries via the ECB's data portal.

For corporations, the interest rate on new loans exceeding €1 million with a floating rate and an initial fixation period of up to three months decreased by 11 basis points to 4.31%.

The rate for new loans of the same amount, with an initial fixation period of over three months and up to one year, fell by 14 basis points to 4.06%.

Additionally, the interest rate on new loans over €1 million with an initial rate fixation period of more than ten years decreased by 6 basis points to 3.42%.

A notable reduction was also seen in loans of up to €250,000, where the average rate charged for floating rate loans with an initial fixation period of up to three months fell by 17 basis points to 4.63%.

In terms of deposits from corporations, the interest rate on deposits with an agreed maturity of up to one year decreased by 13 basis points to 2.80%, and overnight deposits saw a decline of 4 basis points to 0.77%.

The interest rate for new loans to sole proprietors and unincorporated partnerships with a floating rate and an initial fixation period of up to one year experienced a larger decrease of 29 basis points, settling at 4.63%.

For households, the composite cost-of-borrowing indicator for loans aimed at house purchases also saw a decline.

The interest rate on loans with a floating rate and an initial fixation period of up to one year decreased by 12 basis points to 4.15%.

Rates on housing loans with initial fixation periods over one and up to five years fell by 5 basis points to 3.57%, while loans with fixation periods over five up to ten years decreased by 7 basis points to 3.36%.

Further, the rate on loans with an initial fixation period exceeding ten years fell by 7 basis points to 3.09%.

Loans to households for consumption saw a significant drop of 22 basis points, reaching 7.36%.

Regarding deposits from households, the interest rate on deposits with an agreed maturity of up to one year decreased by 16 basis points to 2.45%.

Rates on deposits redeemable at three months' notice remained unchanged at 1.74%, and overnight deposits from households stayed constant at 0.35%.

These interest rate changes reflect ongoing adjustments in the financial landscape of the euro area and come amid broader economic considerations.

The data is part of a comprehensive set of bank interest rate statistics maintained by the ECB, which can be visualized for individual euro area countries via the ECB's data portal.

AI Disclaimer: An advanced artificial intelligence (AI) system generated the content of this page on its own. This innovative technology conducts extensive research from a variety of reliable sources, performs rigorous fact-checking and verification, cleans up and balances biased or manipulated content, and presents a minimal factual summary that is just enough yet essential for you to function as an informed and educated citizen. Please keep in mind, however, that this system is an evolving technology, and as a result, the article may contain accidental inaccuracies or errors. We urge you to help us improve our site by reporting any inaccuracies you find using the "Contact Us" link at the bottom of this page. Your helpful feedback helps us improve our system and deliver more precise content. When you find an article of interest here, please look for the full and extensive coverage of this topic in traditional news sources, as they are written by professional journalists that we try to support, not replace. We appreciate your understanding and assistance.